关键字:DRAM

2011-2013年DRAM市场供需变化

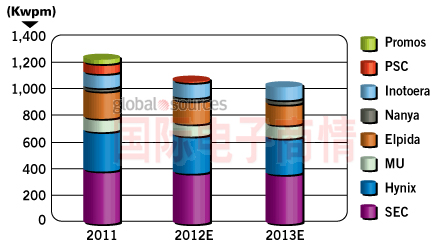

SOURCE: IDC, Gartner, Barclays Research estimates

新市场的特性

Barclays预计,基于寡头市场和产业迁移仍存在难点,DRAM市场将经历一个风平浪静且漫长的复苏阶段。而到2013年,服务器/移动设备取代PC成为需求增长点,将带给DRAM产业一个更好的平稳增长模式。

在尔必达破产并解决了资产处置问题后,DRAM产业将越来越像NAND产业,在供求和定价上也将变得愈加理性。Barclays 认为,尔必达遭遇滑铁卢的境遇就如2009年上半年的SK海力士。美光对尔必达的极具战略性的收购将促使DRAM产业更好地复苏。Barclays还声称,促使市场复苏最关键的还是瑞晶(全球7%产能)和尔必达广岛厂(全球10%产能)的产能转向非DRAM制造。

2011-2013年全球DRAM晶圆产能分析(基于12英寸晶圆)

SOURCE: IDC, Barclays Research estimates

如何产生影响

DRAM产业的波动周期将变窄,因为越来越多的需求是来自于专业领域:库存趋于稳定,产品定制化。而且,寡头时代的顶级厂商也能以更具前瞻性的眼光来控制供应量,保持市场供应的稳定。另外,经过长时间的行业不景气后,大浪淘沙下,存活下来的DRAM厂家是少且优的,这也意味着行业的波动趋向平稳。

在需求方面,即将推出的三星Galaxy S III LTE版将配置2GB DRAM(在Galaxy S III 3G版中仅为1GB),苹果iPhone 5将配置1GB DRAM(iPhone 4S仅为512MB),这将显著地增加2012年第三季度对移动DRAM的需求,并使得产业供应趋向紧张。同时,仅此两种产品的单设备DRAM配置容量增长已相当于额外增加了1000万颗PC DRAM需求,近乎2012年第二季PC DRAM需求的5%。而在服务器领域,单设备DRAM配置容量增长也相当于200万颗,近乎1%的PC需求。

Global DRAM recovery: Is DRAM becoming NAND-like?

The dynamic random access memory (DRAM) recovery is sustainable into 2013, say Barclays Capital analysts. DRAM benefits from a supply discipline that was bolstered by oligopoly/DRAM consolidation and the Elpida bankruptcy; robust demand growth from non-PC applications (server/mobile DRAM bit demand to exceed PC for the first time in 2013E); and potential for additional positives related to Elpida (Hiroshima/Rexchip converted to non-DRAM).

[Figure 1. DRAM supply/demand. SOURCE: IDC, Gartner, Barclays Research estimates.]

Figure 1. DRAM supply/demand. SOURCE: IDC, Gartner, Barclays Research estimates.

What is different from previous cycles? Barclays expects a less dynamic but longer-lived recovery given the oligopoly situation and technological difficulties in geometry migration; and server/mobile DRAM becoming the demand driver, supplanting PC, in 2013, offering a better growth profile and much less volatility.

The DRAM industry is becoming increasingly similar to the NAND industry, and will see an even more rational supply/pricing environment, once Elpida's bankruptcy and asset sale are resolved. Barclays sees the Elpida situation as similar to SK Hynix's stumble in NAND in H1 2009. Micron's strategic choice post acquisition of Elpida could trigger an even better DRAM recovery. The best case scenario would be the disposal of Rexchip (7% of global capacity) and some of Hiroshima fab (10%) migrating to non-DRAM manufacturing, Barclays asserts. Also read: DRAM partially recovers thanks to Elpida bankruptcy

[Figure 2. Global DRAM wafer capacity status. Note: Based on 12-inch wafers. SOURCE: IDC, Barclays Research estimates]

Figure 2. Global DRAM wafer capacity status. Note: Based on 12-inch wafers. SOURCE: IDC, Barclays Research estimates

What does this mean for share price performance? The peak and the trough of the DRAM cycle will narrow as more demand comes from specialty DRAM, which has less inventory swing, being a more customized product; and more proactive supply control by top-tier manufacturers after becoming an oligopoly. Following a prolonged industry downturn, there are currently fewer players in DRAM market, reducing volatility.

The launch of Samsung’s Galaxy S III LTE, which may adopt 2GB DRAM (vs 1GB of 3G Galaxy S III) and Apple’s iPhone 5, which may adopt 1GB DRAM (vs 512MB iPhone 4S) will significantly boost mobile DRAM demand from Q3 2012, driving tight supply. The impact of DRAM content per box growth for just these two models offers the equivalent of 10 million units of additional PC demand (5% of total PC demand) in H2 2012, Barclays estimates. In servers, an incremental increase in content per server should offer the equivalent of 2 million PCs (1% of total PC demand).