关键字:移动设备 MEMS

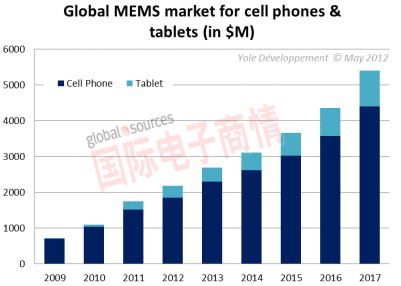

Yole Development的惯性MEMS分析专家Laurent Robin指出:“手机和平板电脑中的MEMS器件市场将以年均20%的速度增长,到2017年营业收入达54亿美元。”

十大MEMS应用

MEMS器件在移动设备中极为流行。不过,尽管如此,目前只有如下3类MEMS器件应用广泛:

1.运动传感器。包括加速计,磁力计和最近大热的陀螺仪。这个领域保持高速增长,技术变革也持续不断。比如,提供更高水平的集成技术和融合算法的组合传感器。

2. MEMS麦克风:取代传统ECM及因手机新功能所需的多个麦克风阵列,MEMS麦克风的市场前景非常光明。

3.BAW滤波器和双工器:很多年前BAW就广泛应用于Band 2中,未来则会应用在4G的基带中。

还有很多MEMS应用正在研发中。Yole的报告提出了一些将极大地影响MEMS市场的新机遇:

1.虽然目前在天气预报中的应用不多,压力传感器将被组合到惯性传感器中以用于提供基于位置的服务(LBS)。

2.RF MEMS在2011年开了个好头,未来将受益于天线调频的发展

3.振荡器则是另一个大热的市场,硅基MEMS有望取代TCXO石英晶振以及集成谐振器。

4.相比于现有的VCM技术,MEMS自动对焦能提供更高的附加值。不过,不可掉以轻心,因为还有很多其它有竞争力的技术。

5.其它类型的MEMS:微显示器、微扬声器、环境传感器、触摸屏、游戏杆等。

厂商排名及未来发展

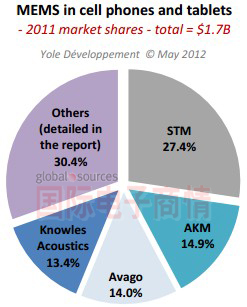

MEMS市场在2009年到2011年间翻了3番,这对每个MEMS制造商而言都是巨大的机会。过去两年来,领先厂商的排名也发生了变化:2009年到2011年,在手机应用市场, ST从第三升至第一,营收也超过了4.77亿美元。而在MEMS加速计领域,ST仍保持其主宰地位。同时,ST也顺利打开了MEMS陀螺仪市场,在该领域能威胁其地位的仅有InvenSense。作为一个顶级供应商,ST正努力在其它MEMS市场扩大其影响力以保持竞争力。ST的主要客户有苹果、三星、诺基亚、 黑莓和惠普。

其它大型MEMS厂商也都有自己的核心市场:AKM销售额为2.60亿美元,称雄于电子罗盘磁力计市场;Avago则以2.44亿美元的营收称霸BAW滤波器和双工器市场;Knowles是MEMS麦克风的领头羊,营收为2.33亿美元。

报告里还指出以下将影响未来竞争格局的趋势:

1. 许多初创公司将推出的颠覆性技术:包括新型市场的RF MEMS开关和可变电容器、用于微型投影仪的扫描微镜、硅定时器、扬声器、自动对焦MEMS等;以及现有市场的mCube惯性传感器、3S麦克风等。

2. 受此市场的高增长及高利润空间吸引,大型半导体公司都开始关注MEMS市场:飞兆半导体和Maxim通过收购进入市场,而其它公司也将紧随其后。

3. 出现新的商业模式:有专攻产业链的特定环节的,如MEMS制造、信号处理等;也有提供完整解决方案的,如整合MCU和软件的组合传感器。

MEMS产业将深受移动设备的全球性趋势影响:设备互联,音像制品消费,社交化网络,用户多样性以及移动广告等。Yole Développement也指出,某种意义上来说,MEMS传感器提供的多种功能也反过来促成了市场对智能手机和平板电脑的爆发性需求。

“20% annual growth to reach $5.4B in 2017!,”announced Yole Développement

“MEMS for Cell Phones & Tablets”, a new report from Yole Développement

Lyon, France – May 22, 2012 – Yole Développement announces its report “MEMS for Cell Phones & Tablets”.

“New MEMS devices will benefit from the mobile device growth that is predicted for the coming years: phones and tablet will represent a 2.9B units in 2017 and most of them will integrate 5 to 10 MEMS devices”, announces Laurent Robin, Activity Leader, Inertial MEMS Devices & Technologies, Yole Développement.

10 new MEMS applications to be >$100M in 2017

MEMS devices are extremely popular in mobile applications. Despite this interest, only 3 categories of MEMS devices are in high volume production today:

? Motion sensors: including accelerometers, magnetometers and more recently gyroscopes is the hottest market segment. It is still growing quickly and many business and technical evolutions are expected. One of them is the launch of combo sensors which provide a higher level of integration and possibly embed sensor fusion algorithms

? MEMS microphones : which are promised to a bright future, driven by ECM replacement and by new functionalities that require multiple microphones

? BAW filters and duplexers : BAW is popular since many years for the Band 2 in particular, and new opportunities will appear with some of the bands that will be used in 4G standards

Many other MEMS products are under development. The report highlights that novel MEMS opportunities need to be watched as they will fuel this market significantly:

? While limited to weather forecast applications today, pressure sensors are going to be used

2

in combination with inertial sensors to provide location-based services

? RF MEMS switches had a successful start in 2011 and will benefit from the current hype for antenna tuning

? Oscillators is another hot area where silicon MEMS has a high potential, both for replacing TCXO quartz oscillators and for integration of resonators

? Another hot market is going to be MEMS auto-focus which provides significant added value compared to the existing VCM technology, but will face competition with other technologies as well

? And many other types of MEMS are emerging: microdisplays, microspeakers, environmental sensors, touchscreen, joystick…

Newcomers to join ST and the other leaders in this attractive market

Opportunities are thus huge for MEMS device makers, as this market tripled from 2009 to 2011. The ranking of the top players has also evolved the past 2 years: ST Microelectronics was number 3 in cell phone applications in 2009 and is now the number one supplier by far with $477M cellphone and tablet revenue in 2011. ST Microelectronics still dominates the MEMS accelerometer market, had an impressive start with MEMS gyroscopes, only challenged by InvenSense, and continues to expand to many other MEMS devices to become a one-stop supplier.

ST Microelectronics major clients are Apple, Samsung, Nokia, RIM and HP. Other large players are very focused on their core markets: AKM is the number 2 with $260M sales of magnetometers for electronics compass solution, Avago is leading the BAW filters and duplexers market with $244M sales, and Knowles is number 4 with $233M revenues from MEMS microphones. The trends which are shaping the competitive landscape of tomorrow are analyzed carefully in this report:

? Many start-ups are about to introduce disruptive technologies on the market: both for emerging markets (RF MEMS switches and variable capacitors, scanning mirrors for picoprojectors, silicon timing devices, speakers, auto-focus…) and for the current large markets (MCube for inertial sensors, 3S for microphones…)

? Attracted by this growing and high-margin market space, large semiconductor companies are now eyeing MEMS: Fairchild and Maxim already made the move through acquisitions, and others should follow

? New business models are being developed and it appears that some players specialize on a specific part of the value chain (MEMS manufacturing, signal processing…) while others are offering complete solutions (e.g. combo sensors which integrate MCU and software)

“The market for MEMS in cell phones and tablets will grow 19.8% to reach a $5.4B value in 2017”, says Laurent Robin, Activity Leader Inertial MEMS Devices & Technologies, Yole Développement. The MEMS industry will be largely impacted by global trends in mobile devices: connected devices, video and music consumption, social networking, diversity of users and usages, mobile advertising. In the reverse way, Yole Développement also notes that the booming demand for smartphones and media tablets can be partly explained by the integration of MEMS sensors which provide new functionalities.